Buy signal? XRP set for explosive price action after consolidation

The XRP community continues to await a possible price breakout, potentially reclaiming the $1 mark after years of extended consolidation. This comes as the token’s parent company, Ripple, remains embroiled in a legal battle with the Securities and Exchange Commission (SEC).

However, crypto analyst Egrag Crypto believes historical price movements suggest that XRP might be on the verge of explosive price action, potentially driving the value above $1.

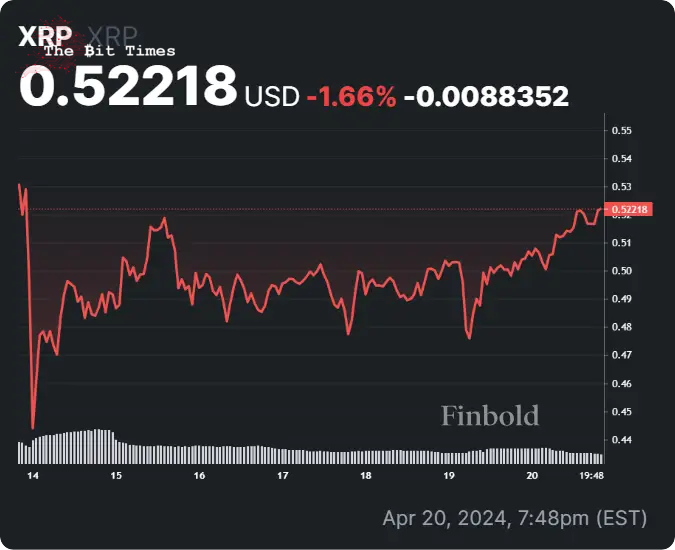

In an X (formerly Twitter) post on April 20, the analysis suggested that XRP’s dominance rests on a historical support line around the $0.50 zone, drawing parallels to patterns observed in 2017 and 2021.

Picks for you

According to the expert, the support line could provide the basis for XRP to break out, noting that the token has built a reputation for recording rapid and powerful price surges from such positions.

XRP’s areas to watch

If this scenario unfolds, the analyst identified potential targets for XRP’s price movement, pinpointing Fibonacci levels between $1.2 and $1.6 as critical areas of interest. These levels serve as crucial indicators for traders and investors, signaling potential price targets and resistance levels.

“Historically, XRP has exhibited rapid and powerful pumps. Could we witness a similar move soon? Potential targets begin at Fib levels 1.272, 1.414, and 1.618,” the analyst said.

For XRP to realize the projected valuation, the token must sustain its price above the psychological $0.50 level, which currently serves as a critical support point. This level could also help the token breakout of consolidation above the $0.70 mark.

Meanwhile, the SEC case weighs on determining XRP’s next move. The case is approaching a potential conclusion, with the SEC urging a New York judge to impose a hefty, nearly $2 billion fine against Ripple Labs.

Beyond the case, XRP could also find support from Ripple Labs’ potential stablecoin launch. It’s worth noting that Ripple intends to unveil its stablecoin, which entails a 1:1 peg with the US dollar and is backed 100% by US dollar deposits, short-term government treasuries, and other cash equivalents.

XRP price analysis

By press time, XRP was trading at $0.52218, ranking among the biggest gainers in the crypto market in the last 24 hours with a rise of 4%. However, on the weekly chart, XRP is down 1.6%.

Overall, the short-term price movement could indicate that XRP’s movement suggests a successful bullish breakout, likely to transition into a sustained rally. However, sustainability largely depends on how the general market moves.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.

Comments

Post a Comment