Crypto market loses over $400 billion in a week as charts turn red

As the majority of assets in the cryptocurrency sector nears the end of another week in the red, the market’s total capitalization has declined over $400 billion in just seven days, led by the industry’s representative, Bitcoin (BTC), which is trading in the $61,000 area.

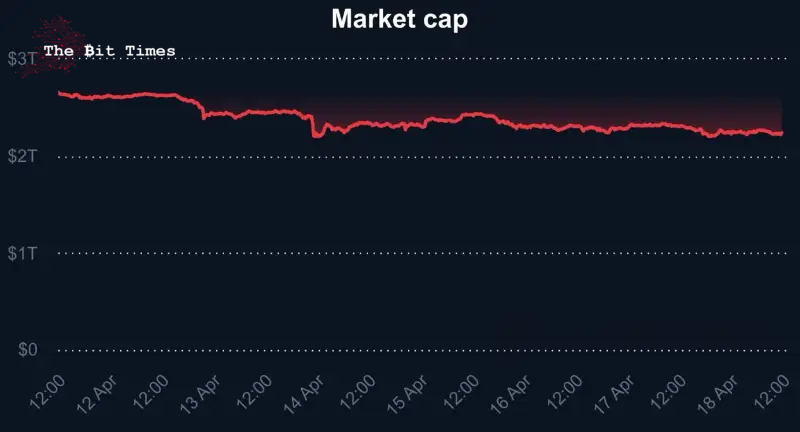

Specifically, the crypto market has dropped from $2.65 trillion on April 11 to the current $2.24 trillion, which equals a loss of a whopping $410 billion or 15.47% in a single week, according to the most recent chart data retrieved by Finbold from the crypto analytics platform CoinMarketCap on April 18.

Why is crypto market down?

So, why is the crypto market down? Notably, one of the reasons could be the escalating geopolitical tensions around the world, particularly in the Middle East – between Israel and Iran – which have sent fears across the globe and the markets tumbling amid investor panic and sell-offs.

Picks for you

At the same time, the United States Dollar Index is getting stronger due to delayed rate cuts, which has often had a divergent effect on the prices in the crypto industry, particularly Bitcoin, the flagship decentralized finance (DeFi) asset, which has dipped 12.45% in the previous seven days.

That said, signs of hope remain, especially if the bulls prevail and the maiden crypto asset manages to defend its position at $61,000, after which it could recover toward reclaiming $66,500, as opposed to losing this position and dropping further to $56,200, Finbold reported earlier.

It is worth noting that one of the most important factors contributing to its possible recovery is Bitcoin’s approaching halving date on April 19, an event that has historically had a positive effect on the price of the largest asset in the crypto sector and, consequently, the rest of the market.

All things considered, charts may look bleak now, but Bitcoin halving, one of the most important events in the crypto industry, could bring the necessary relief, so the current dip could represent an ideal opportunity to strengthen one’s positions before the rally happens. However, doing one’s own research is critical here.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.

Comments

Post a Comment