Solana will unlock $2 billion of SOL on March 1 from FTX estate – Sell time?

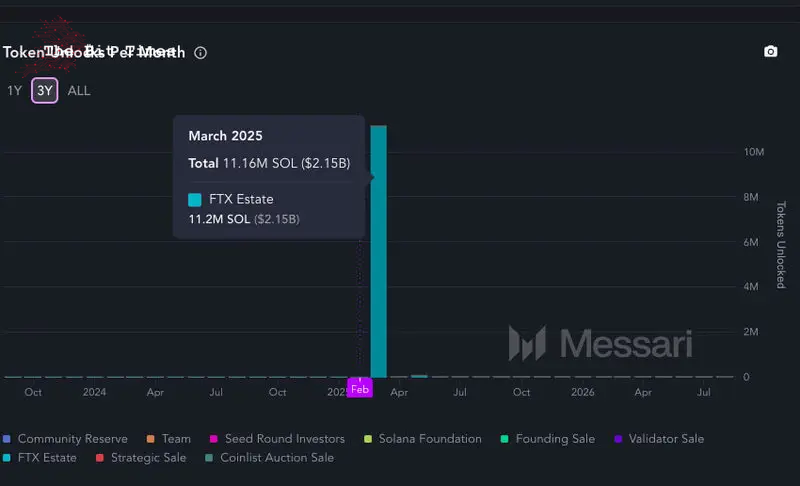

Solana (SOL) vesting contracts will unlock 11.16 million SOL on March 1, worth over $2 billion at current prices. This will come from tokens previously bought and later sold by the defunct exchange FTX, part of the bankruptcy process.

As informed in a Blockworks newsletter, “the FTX estate sold off a number of still-locked tokens to investors at a significant discount to the market price,” after the exchange went bankrupt. Data from Messari shows that the FTX Estate has 11.2 million SOL to be unlocked, including March 1’s event.

This upcoming unlock amount represents over 2.2% of Solana’s circulating supply of 488.28 million SOL, according to CoinMarketCap. While a massive sell-off is possible, considering the buyers are already in profit, some analysts believe the threat is low.

Picks for you

Matt Maximo, an investor at VanEck, for example, says he personally knows some buyers who claim will not sell before getting a ten-fold return over this investment. Nevertheless, intentions can change over time and it is impossible to predict human behavior.

“The FTX estate sale of Solana tokens … attracted many new investors to SOL. We will soon learn how many of them stick around for the long term,”

said Matthew Sigel, VanEck head of digital assets.

Solana (SOL) price analysis with upcoming FTX unlock

By press time, SOL is trading at $198.61, failing to break above the $200 psychological support and resistance level. Solana is struggling at what looks like a technical consolidation range after crashing in early February together with other cryptocurrencies.

Solana now registers 2% losses in the last 30 days, but is down 30% from this period’s top at $286.

Thus, the upcoming $2 billion unlock on March 1 could put even more pressure on SOL’s price in this context. Investors who were previously bullish could see this as an extra incentive to derisk and realize the current profit, increasing the potential selling pressure, unless sentiment changes.

As the massive unlock approaches, SOL holders and investors will have a critical decision to make in the following weeks. Proper risk management and mitigation strategies will be crucial to navigate what is next for Solana. Yet, this will also mark a significant milestone, leaving this FTX estate ghost behind, opening doors for future growth.

Featured image from Shutterstock.

Comments

Post a Comment